The trade value chart is more than just numbers on a page; it's a strategic tool that can transform your investment decisions. Understanding how to interpret and utilize this chart can lead to significant improvements in your trading outcomes. Whether you're a seasoned investor or a novice trader, integrating trade value charts into your analysis can help you navigate the financial markets with greater precision and confidence.

In the world of finance, the ability to assess the worth of different assets is a critical skill. The trade value chart serves as a comprehensive guide for traders and investors, providing a visual representation of the relative value of various commodities, stocks, or other assets. These charts are used across multiple industries to make informed decisions about buying, selling, or holding assets, making them an indispensable part of the trading toolkit.

While the concept of trade value charts might seem complex at first glance, understanding their mechanics is crucial for anyone involved in trading. By learning to read and interpret these charts, traders can gain insights into market trends, identify potential opportunities, and make well-informed decisions that align with their financial goals. This article will delve deep into the world of trade value charts, offering insights and strategies to help you harness their full potential.

Read also:The Ultimate Guide To Sukoshi Mart Your Goto Destination For Japanese Lifestyle Products

Table of Contents

- What is a Trade Value Chart?

- History and Evolution of Trade Value Charts

- Understanding the Components of a Trade Value Chart

- How to Read a Trade Value Chart?

- Importance of Trade Value Charts in Investing

- Common Mistakes to Avoid

- Developing Your Trade Value Chart Strategy

- Trade Value Chart Tools and Resources

- Case Study: Successful Trade Value Chart Application

- Trade Value Charts Across Different Markets

- Future Trends in Trade Value Charting

- How Do Trade Value Charts Impact Market Decisions?

- Trade Value Chart vs Other Investment Tools: Which is Better?

- Frequently Asked Questions

- Conclusion

What is a Trade Value Chart?

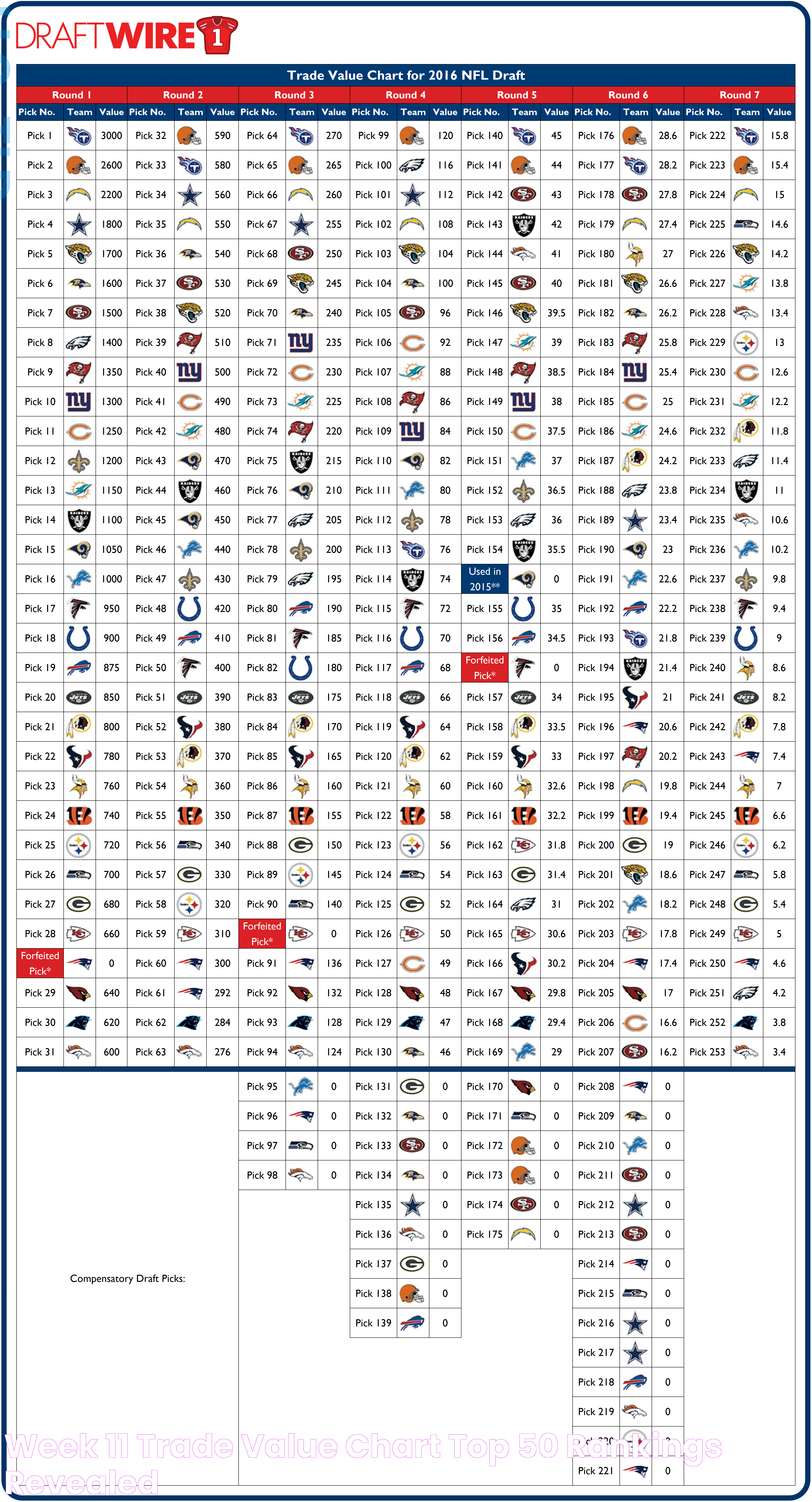

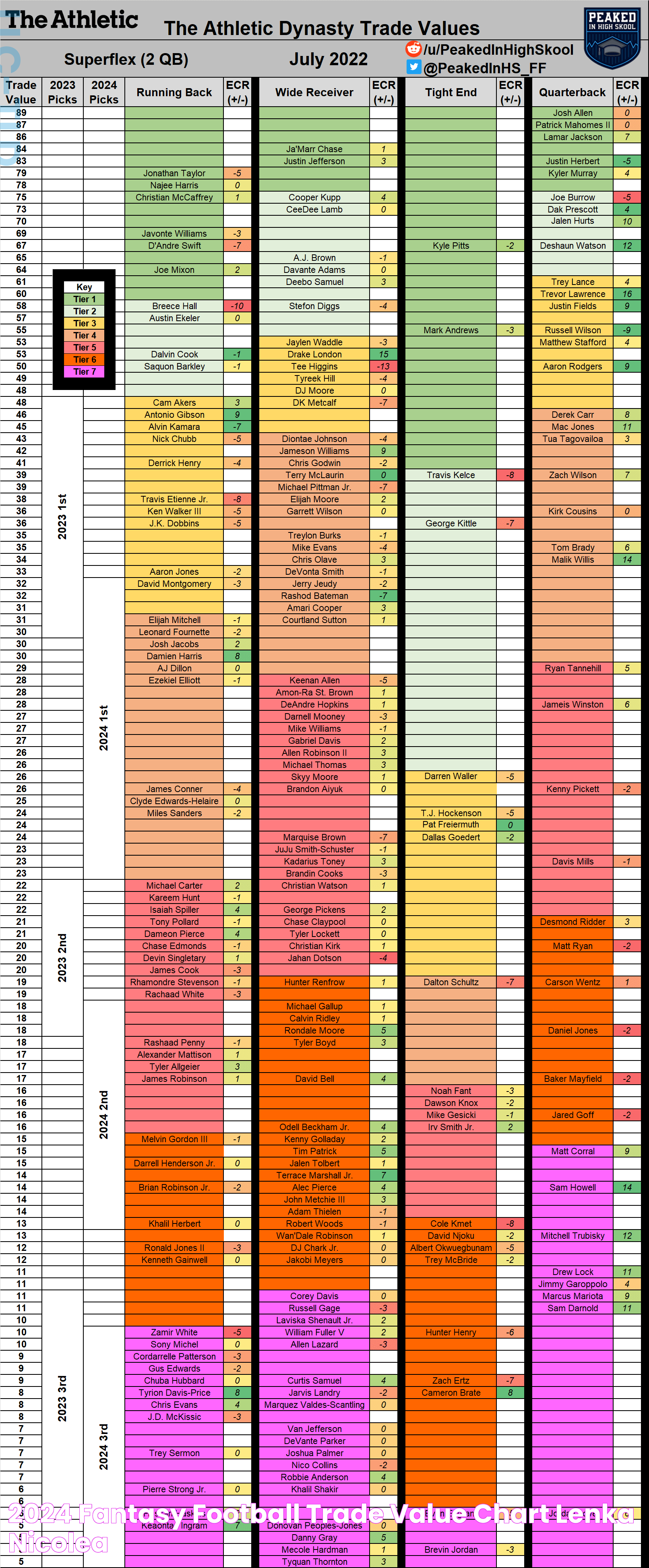

A trade value chart is a graphical representation that helps traders and investors determine the relative value of different assets. It is a tool used primarily to assess and compare the worth of various commodities, stocks, or securities, facilitating more informed trading decisions. These charts are essential for identifying market trends, analyzing asset performance, and predicting future price movements.

Trade value charts typically plot data points on a graph, showcasing the historical and current value of an asset. They allow traders to visualize the fluctuations in asset prices over time, making it easier to identify patterns and potential investment opportunities. The charts are used by professional investors, financial analysts, and traders of all experience levels to guide their investment strategies.

Understanding trade value charts is crucial for anyone involved in the financial markets. By accurately interpreting these charts, traders can make strategic decisions that maximize their potential returns while minimizing risks. These charts provide a quick snapshot of an asset's value, enabling investors to assess whether it is undervalued, overvalued, or fairly valued in relation to other assets.

History and Evolution of Trade Value Charts

The concept of trade value charts has evolved significantly over the years. Initially, traders relied on paper-based charts and manual calculations to assess asset values. With the advent of digital technology, the process became more streamlined and accessible, allowing for real-time data analysis and more accurate predictions.

In the early days of trading, charts were simple, often displaying basic price information without much detail. As the financial markets expanded and became more complex, so did the charts. The introduction of computerized trading systems revolutionized the way traders analyzed data, making it possible to incorporate a wide range of variables and indicators into trade value charts.

Today, trade value charts are sophisticated tools that integrate advanced algorithms and data visualization techniques. They can incorporate various data sources, such as historical prices, volume data, and technical indicators, to provide a comprehensive overview of an asset's performance. This evolution has made trade value charts indispensable for modern traders, enabling them to navigate volatile markets with greater accuracy and confidence.

Read also:Knapp Pizza The Ultimate Guide To A Timeless Culinary Delight

Understanding the Components of a Trade Value Chart

A trade value chart consists of several key components that work together to provide a detailed view of an asset's value. Understanding these components is essential for accurately interpreting the chart and making informed trading decisions.

- Price Axis: The vertical axis of the chart, typically representing the price of the asset. It shows the range of prices over a specific period.

- Time Axis: The horizontal axis, representing the time frame over which the data is plotted. It can range from minutes to years, depending on the trader's needs.

- Data Points: Individual points on the chart that represent the asset's price at a given time. Connecting these points forms a line or candlestick pattern.

- Indicators: Technical tools, such as moving averages or relative strength index (RSI), that provide additional insights into the asset's performance.

- Volume: Often displayed as bars at the bottom of the chart, indicating the number of shares or contracts traded over the selected time frame.

By analyzing these components, traders can gain a deeper understanding of market dynamics and make more informed decisions. It's important to note that while trade value charts provide valuable insights, they should be used in conjunction with other analysis tools and strategies to achieve the best results.

How to Read a Trade Value Chart?

Reading a trade value chart might seem daunting at first, but with a basic understanding of its components, it becomes a powerful tool for traders. Here are some steps to help you effectively read and interpret a trade value chart:

- Identify the Time Frame: Determine the period covered by the chart. Short-term traders might focus on intraday charts, while long-term investors may analyze weekly or monthly charts.

- Analyze Price Movements: Observe the trend of the asset's price. Is it moving upward, downward, or sideways? Recognizing the trend is crucial for making informed trading decisions.

- Look for Patterns: Identify patterns such as head and shoulders, triangles, or double tops/bottoms. These patterns can signal potential reversals or continuations in the price trend.

- Consider Technical Indicators: Use indicators like moving averages, Bollinger bands, or MACD to gain insights into the asset's momentum and potential price direction.

- Assess Volume Data: Volume can provide clues about the strength of a price movement. High volume often confirms trends, while low volume might indicate potential reversals.

By following these steps, traders can gain a comprehensive understanding of trade value charts, allowing them to make strategic decisions based on market data. Remember, practice and experience are key to mastering the art of reading these charts.

Importance of Trade Value Charts in Investing

Trade value charts play a pivotal role in the world of investing. They offer a wide range of benefits that can significantly enhance a trader's ability to make informed decisions. Here are some reasons why trade value charts are essential tools for investors:

- Visual Representation: Charts provide a clear and concise visual representation of an asset's historical and current value, making it easier to spot trends and patterns.

- Data Analysis: By analyzing historical data, traders can identify potential entry and exit points, improving their chances of executing profitable trades.

- Risk Management: Charts help traders assess potential risks by highlighting key support and resistance levels, allowing them to set appropriate stop-loss orders.

- Market Sentiment: Trade value charts can offer insights into market sentiment, helping traders gauge whether the market is bullish, bearish, or neutral.

- Strategic Planning: By incorporating trade value charts into their analysis, traders can develop more effective investment strategies that align with their financial goals.

Ultimately, trade value charts are invaluable tools that provide traders with the information they need to make strategic decisions. By leveraging these charts, investors can enhance their trading performance and achieve their investment objectives.

Common Mistakes to Avoid

While trade value charts can be powerful tools for traders, there are common mistakes that can hinder their effectiveness. By being aware of these pitfalls, traders can avoid making costly errors:

- Overreliance on Charts: Relying solely on charts for trading decisions can lead to missed opportunities. It's important to consider other factors, such as fundamental analysis and market news.

- Ignoring Time Frames: Using the wrong time frame can lead to inaccurate analysis. Ensure the selected time frame aligns with your trading strategy and objectives.

- Neglecting Volume Data: Volume is a crucial component of trade value charts. Failing to consider volume can result in misinterpretation of price movements.

- Chasing Trends: Jumping on trends without proper analysis can lead to losses. Validate trends with technical indicators and other analysis tools before making decisions.

- Lack of Risk Management: Failing to set stop-loss orders or ignoring risk management principles can lead to significant losses. Always have a risk management strategy in place.

By avoiding these common mistakes, traders can maximize the effectiveness of trade value charts and improve their trading outcomes. Consistent learning and practice are essential for mastering the use of these charts.

Developing Your Trade Value Chart Strategy

Creating a successful trade value chart strategy requires careful planning and analysis. Here are some steps to help you develop an effective strategy:

- Define Your Goals: Clearly outline your trading objectives, such as short-term gains, long-term investments, or risk management.

- Select the Right Tools: Choose the appropriate trade value charts and technical indicators that align with your strategy.

- Conduct Thorough Analysis: Analyze historical data, market trends, and potential patterns to identify opportunities.

- Implement Risk Management: Set stop-loss orders and position sizes to manage risk effectively.

- Review and Adapt: Regularly review your strategy's performance and make necessary adjustments to optimize results.

Developing a trade value chart strategy is an ongoing process that requires continuous learning and adaptation. By following these steps, traders can create a strategy that aligns with their goals and maximizes their potential returns.

Trade Value Chart Tools and Resources

There are numerous tools and resources available to help traders effectively utilize trade value charts. Here are some popular options:

- Charting Platforms: Platforms like TradingView, MetaTrader, and Thinkorswim offer advanced charting capabilities and a wide range of technical indicators.

- Technical Analysis Books: Books such as "Technical Analysis of the Financial Markets" by John J. Murphy provide in-depth insights into chart analysis.

- Online Courses: Platforms like Coursera and Udemy offer courses on technical analysis and charting strategies.

- Financial News Websites: Websites like Bloomberg and CNBC provide real-time market news and analysis that can complement chart analysis.

- Trading Communities: Online forums and communities, such as Reddit's r/StockMarket, offer opportunities to learn from experienced traders.

By leveraging these tools and resources, traders can enhance their understanding of trade value charts and improve their trading performance. Continuous learning and staying informed about market developments are key to success in trading.

Case Study: Successful Trade Value Chart Application

To illustrate the effectiveness of trade value charts, let's explore a case study of a successful application:

In 2022, a trader named Sarah, with several years of experience, decided to incorporate trade value charts into her investment strategy. She focused on analyzing the historical data of a tech stock that had been experiencing significant price fluctuations.

By using trade value charts, Sarah identified a head and shoulders pattern, signaling a potential price reversal. She also noticed a strong support level, confirmed by high trading volumes. Based on this analysis, Sarah decided to buy the stock at the support level, anticipating a rebound.

Her decision proved successful as the stock's price soon rallied, resulting in substantial gains. Sarah's ability to effectively analyze trade value charts played a crucial role in her success, highlighting the importance of these tools in making informed trading decisions.

Trade Value Charts Across Different Markets

Trade value charts are not limited to a single market; they can be applied across various asset classes. Here's how they are used in different markets:

- Stock Market: In the stock market, trade value charts help traders analyze individual stocks, sectors, and indices to identify investment opportunities.

- Forex Market: In the forex market, charts are used to analyze currency pairs and predict exchange rate movements.

- Commodity Market: Traders use charts to assess the value of commodities like gold, oil, and agricultural products, identifying potential price trends.

- Cryptocurrency Market: In the volatile world of cryptocurrencies, trade value charts help traders navigate price fluctuations and make informed decisions.

Regardless of the market, trade value charts provide valuable insights that can guide traders in making strategic decisions. By understanding how to apply these charts across different markets, traders can diversify their portfolios and explore new investment opportunities.

Future Trends in Trade Value Charting

As technology continues to evolve, so too does the field of trade value charting. Here are some trends that are shaping the future of chart analysis:

- Artificial Intelligence: AI is being integrated into charting platforms to provide more accurate predictions and automate trading decisions.

- Machine Learning: Machine learning algorithms are being used to identify patterns and trends that may not be visible to the human eye.

- Real-Time Data: The availability of real-time data is enhancing the accuracy of trade value charts, allowing for more timely decision-making.

- Blockchain Technology: Blockchain is providing greater transparency and security in trading, impacting how data is used in chart analysis.

- Social Trading: Social trading platforms are enabling traders to share insights and strategies, fostering collaboration in chart analysis.

By staying informed about these trends, traders can leverage new technologies to enhance their chart analysis and improve their trading outcomes. The future of trade value charting is bright, offering exciting opportunities for traders worldwide.

How Do Trade Value Charts Impact Market Decisions?

Trade value charts have a profound impact on market decisions, influencing how traders and investors approach their strategies. Here's how these charts contribute to decision-making:

- Informed Decisions: Charts provide the data needed to make informed decisions, reducing uncertainty and increasing confidence.

- Trend Analysis: By identifying trends, traders can align their strategies with market movements, improving their chances of success.

- Risk Assessment: Charts highlight potential risks, allowing traders to implement risk management strategies and protect their investments.

- Strategy Development: Analyzing charts helps traders develop and refine their strategies, aligning them with market conditions.

Overall, trade value charts are essential tools that empower traders to make strategic decisions with greater accuracy and confidence. By leveraging these charts, traders can navigate the complexities of the financial markets and achieve their investment goals.

Trade Value Chart vs Other Investment Tools: Which is Better?

When it comes to investment tools, traders have a wide range of options at their disposal. Here's how trade value charts compare to other popular investment tools:

- Fundamental Analysis: While fundamental analysis focuses on a company's financial health, trade value charts emphasize price trends and technical indicators.

- Quantitative Analysis: Quantitative analysis relies on mathematical models, while charts provide a visual representation of data, making it easier to interpret trends.

- News and Market Sentiment: News and sentiment analysis offer insights into market dynamics, but charts provide a historical perspective on price movements.

Ultimately, the effectiveness of trade value charts depends on how they are used in conjunction with other tools. By combining different analysis methods, traders can gain a comprehensive understanding of the markets and make well-informed decisions.

Frequently Asked Questions

What is the primary purpose of a trade value chart?

The primary purpose of a trade value chart is to provide a visual representation of an asset's historical and current value, helping traders identify trends and make informed investment decisions.

How can I improve my skills in reading trade value charts?

To improve your skills, practice regularly by analyzing different charts, learn from experienced traders, and consider taking online courses or reading books on technical analysis.

Are trade value charts useful for beginner traders?

Yes, trade value charts are valuable tools for beginner traders as they offer insights into market trends and help develop a deeper understanding of asset values.

Can trade value charts predict future price movements?

While trade value charts can provide insights into potential price movements, they are not foolproof predictors. They should be used alongside other analysis tools and strategies.

What are some popular charting platforms?

Popular charting platforms include TradingView, MetaTrader, and Thinkorswim, each offering a range of tools and features for effective chart analysis.

How do trade value charts differ from other chart types?

Trade value charts focus specifically on the relative value of assets, while other chart types may emphasize different aspects, such as volume or volatility.

Conclusion

In conclusion, trade value charts are indispensable tools that empower traders to make informed decisions in the dynamic world of finance. By understanding the components, strategies, and applications of these charts, traders can enhance their ability to navigate market trends and achieve their investment goals. Whether you're a seasoned investor or just starting, mastering the art of trade value charts can significantly impact your trading success. With continuous learning and adaptation, the potential for success in trading is boundless.