The South Carolina Department of Revenue (SCDOR) is a critical pillar in the state’s economic structure, tasked with the administration and collection of various taxes to fund state services. Established to ensure a smooth flow of revenue, the department plays a pivotal role in the financial well-being of South Carolina. Its operations are designed to enhance compliance, streamline tax processes, and provide clear guidance to taxpayers.

With its headquarters situated in Columbia, the SCDOR is committed to maintaining transparency and efficiency in tax collection. It manages a wide array of taxes and fees, including income, sales, property, and alcohol taxes, among others. The department’s mission is to support the financial infrastructure of the state by ensuring that tax laws are applied fairly and consistently, thus fostering a healthy economic environment.

The SCDOR also emphasizes taxpayer education and assistance as part of its service delivery model. By offering resources, workshops, and one-on-one consultations, the department aims to make tax compliance straightforward and accessible for all South Carolinians. This proactive approach not only aids in compliance but also strengthens the trust between taxpayers and the government, ensuring a collaborative relationship that benefits the state’s overall economic health.

Read also:Inside The Mission And Impact Of Shriners Childrens Hospital A Beacon Of Hope

Table of Contents

- What are the roles and responsibilities of the South Carolina Department of Revenue?

- Types of taxes administered by the South Carolina Department of Revenue

- How does the South Carolina Department of Revenue assist taxpayers?

- Ensuring compliance and enforcement of tax laws

- Technological advancements in tax administration

- Impact of the South Carolina Department of Revenue on the state’s economy

- Challenges faced by the South Carolina Department of Revenue

- Future initiatives and strategic plans

- Partnerships and collaborations with other agencies

- Public education and outreach programs

- Frequently Asked Questions

- Conclusion

What are the roles and responsibilities of the South Carolina Department of Revenue?

The South Carolina Department of Revenue (SCDOR) stands as the chief custodian of the state’s fiscal responsibilities. Its roles encompass a variety of functions that are pivotal to the state’s financial management and economic growth. Primarily, the department is responsible for the administration, collection, and enforcement of state tax laws. This involves the assessment of taxes across different sectors, ensuring that individuals and businesses comply with tax obligations.

Moreover, the SCDOR is tasked with the implementation of policy initiatives that align with the state's economic goals. By working closely with other governmental bodies, the department influences tax legislation and reforms that promote economic stability and growth. It also provides oversight on revenue collection methods to ensure efficacy and accountability, thereby safeguarding public funds.

Another critical responsibility is the provision of guidance and resources to taxpayers. This includes disseminating information on tax regulations, offering assistance in tax filing, and resolving disputes related to tax assessments. The department’s commitment to service excellence is evident in its efforts to deliver timely and accurate information to taxpayers, thus facilitating compliance and enhancing taxpayer satisfaction.

Types of taxes administered by the South Carolina Department of Revenue

The SCDOR administers a comprehensive range of taxes, each contributing significantly to the state’s revenue. These taxes are meticulously categorized to cover various aspects of economic activity, ensuring a balanced approach to revenue collection. The primary categories include:

Income Tax

Income tax is one of the most significant sources of revenue for the state. It applies to both individual and corporate incomes, with rates structured to reflect the earnings of taxpayers. The department ensures that income tax laws are upheld and provides mechanisms for efficient filing and payment.

Sales and Use Tax

Sales tax is levied on the sale of goods and services within South Carolina, while use tax applies to goods purchased outside the state but used within. The SCDOR oversees the collection of these taxes to ensure fair trade practices and compliance with state laws.

Read also:Ultimate Guide To City Market Charleston South Carolina History Attractions And Tips

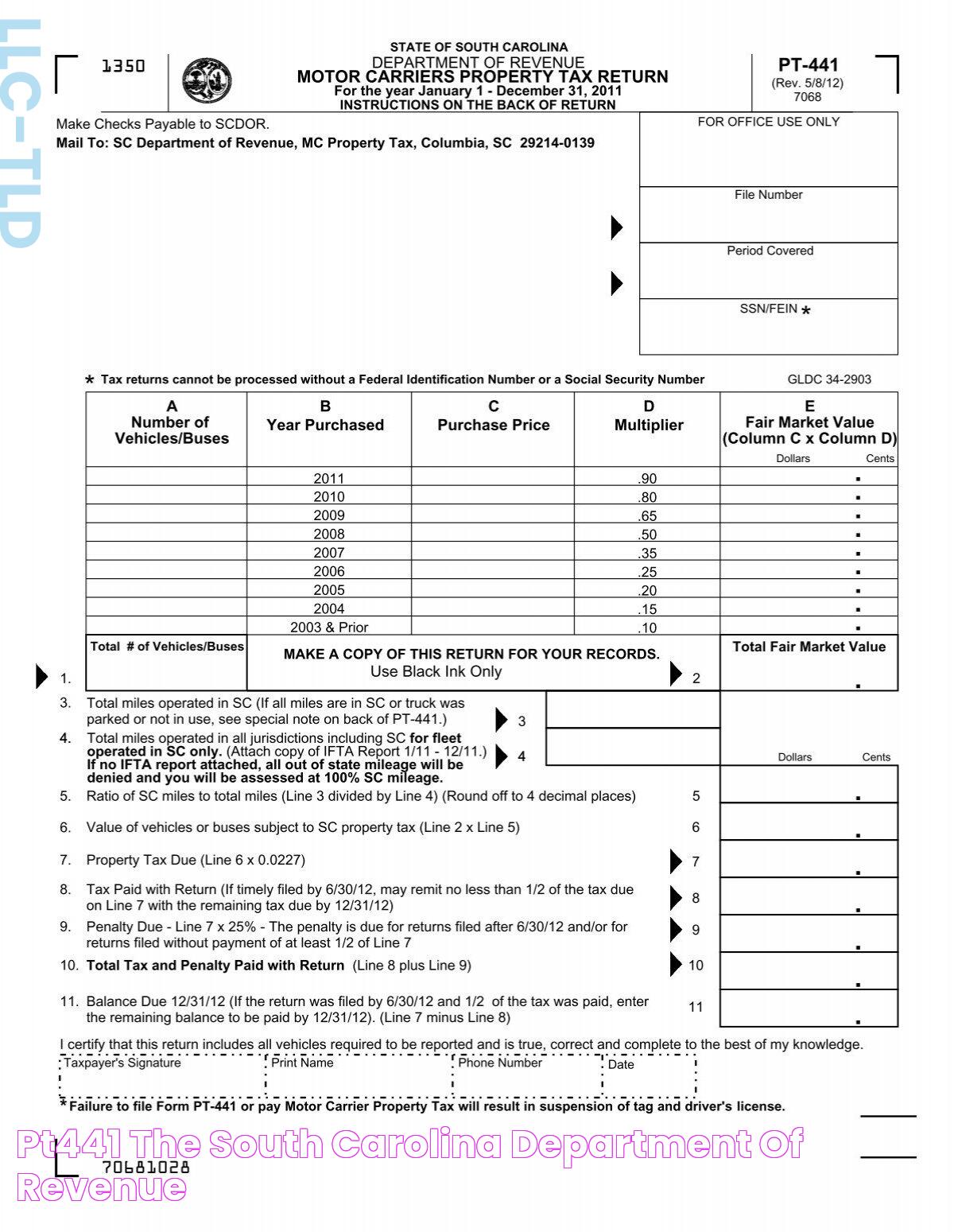

Property Tax

Property tax is administered at the local level but under the guidance of the SCDOR. This tax is crucial for funding local services such as education, public safety, and infrastructure. The department ensures uniformity and fairness in property assessments and tax rates.

Excise Taxes

These are taxes on specific goods, such as alcohol and tobacco, aimed at regulating consumption and generating revenue. The SCDOR regulates the distribution of excise taxes and monitors compliance to prevent illegal trade practices.

How does the South Carolina Department of Revenue assist taxpayers?

The SCDOR is dedicated to providing comprehensive support to taxpayers, ensuring that tax obligations are met with ease and accuracy. This assistance extends through various channels designed to cater to different taxpayer needs. The department’s approach is characterized by accessibility, transparency, and responsiveness.

Online Resources

The SCDOR offers a wealth of online resources, including detailed guides, FAQs, and instructional videos. These resources are tailored to educate taxpayers on filing procedures, tax law changes, and compliance requirements. By providing such information digitally, the department ensures that taxpayers have easy access to the tools necessary for fulfilling their tax responsibilities.

Workshops and Seminars

Regular workshops and seminars are organized to engage with the community directly. These events cover a wide spectrum of topics, from basic tax filing to complex regulatory updates, and are designed to enhance taxpayer understanding and compliance. They also serve as platforms for taxpayers to interact with tax experts and clarify doubts.

Ensuring compliance and enforcement of tax laws

Compliance and enforcement are core functions of the SCDOR, ensuring that all taxpayers adhere to state tax laws. The department employs a multifaceted strategy to uphold these standards, utilizing both preventive and corrective measures.

Audits and Investigations

Audits are conducted regularly to verify the accuracy of tax filings and identify discrepancies. These audits are critical in maintaining the integrity of the tax system, deterring fraud, and ensuring that taxpayers report their financial activities correctly. Investigations are also carried out when there is suspicion of tax evasion or fraud, with the department leveraging advanced techniques to uncover violations.

Penalties and Incentives

To encourage compliance, the SCDOR imposes penalties for non-compliance while also offering incentives for timely and accurate tax filings. These measures are designed to foster a culture of voluntary compliance, reducing the need for enforcement actions and promoting a fair tax environment.

Technological advancements in tax administration

In recent years, the SCDOR has embraced technological advancements to enhance its tax administration processes. The integration of digital solutions has revolutionized the way taxes are collected, processed, and managed, leading to increased efficiency and accuracy.

Electronic Filing Systems

The introduction of electronic filing systems has streamlined the tax filing process, allowing taxpayers to submit their returns online. This has reduced the processing time significantly and minimized errors associated with manual entries. The system also provides real-time updates, enabling taxpayers to track the status of their filings.

Data Analytics

Data analytics is another area where the SCDOR has made significant strides. By analyzing large sets of data, the department can identify trends, detect anomalies, and gain insights into taxpayer behavior. This information is invaluable for policy formulation and strategic decision-making.

Impact of the South Carolina Department of Revenue on the state’s economy

The SCDOR’s influence on the state’s economy is profound, as it directly affects fiscal policies and economic stability. By ensuring robust tax collection, the department provides the financial resources necessary for public services and infrastructure development, which are vital for economic growth.

Moreover, the department’s efforts to create a fair and transparent tax system contribute to a positive business environment, attracting investments and fostering entrepreneurship. This, in turn, leads to job creation and increased economic activity, benefiting the state’s residents and enhancing their quality of life.

Challenges faced by the South Carolina Department of Revenue

Despite its successes, the SCDOR faces numerous challenges that impact its operations. These challenges include keeping up with rapid changes in tax laws, dealing with complex tax evasion schemes, and managing limited resources effectively.

Additionally, the department must navigate the intricacies of modern technology, ensuring that its systems are secure from cyber threats while maintaining user-friendly interfaces for taxpayers. Addressing these challenges requires continuous innovation and adaptation, underscoring the need for strategic planning and collaboration with other stakeholders.

Future initiatives and strategic plans

Looking ahead, the SCDOR is focused on several key initiatives aimed at enhancing its efficiency and service delivery. These include the expansion of digital services, further integration of artificial intelligence in tax processes, and strengthening partnerships with other governmental and non-governmental organizations.

The department is also committed to expanding its outreach programs to ensure that all South Carolinians are informed about their tax obligations and the benefits of compliance. By fostering a culture of transparency and collaboration, the SCDOR aims to build a resilient tax system that supports the state’s long-term economic goals.

Partnerships and collaborations with other agencies

Collaboration is a cornerstone of the SCDOR’s operational strategy, with the department actively seeking partnerships with other government agencies and private sector entities. These partnerships are instrumental in sharing resources, expertise, and information, thereby enhancing the overall effectiveness of tax administration.

For instance, the SCDOR collaborates with local governments to ensure uniformity in tax collection and compliance. It also works with federal agencies to align with national tax policies and regulations. These collaborative efforts not only streamline operations but also promote a cohesive approach to fiscal management across different jurisdictions.

Public education and outreach programs

The SCDOR places a strong emphasis on public education as part of its mandate to enhance taxpayer compliance. Through various outreach programs, the department seeks to inform and educate the public about tax laws, filing procedures, and the importance of compliance.

These programs include workshops, seminars, and community events, where taxpayers can interact with SCDOR representatives and gain insights into the tax system. The department also utilizes social media and other digital platforms to reach a broader audience, ensuring that educational content is accessible to all.

Frequently Asked Questions

What is the primary function of the South Carolina Department of Revenue?

The primary function of the SCDOR is to administer and collect state taxes, ensuring compliance with tax laws and providing resources to assist taxpayers in fulfilling their obligations.

How can I contact the South Carolina Department of Revenue for assistance?

You can contact the SCDOR through their official website, where you can find contact information for various departments, or visit their physical offices in Columbia for in-person assistance.

What types of taxes does the SCDOR manage?

The SCDOR manages several types of taxes, including income tax, sales and use tax, property tax, and excise taxes on alcohol and tobacco.

Are there any penalties for late tax filings in South Carolina?

Yes, the SCDOR imposes penalties for late tax filings to encourage timely compliance. It is advisable to file taxes promptly to avoid these penalties.

Does the SCDOR offer any tax relief programs?

Yes, the SCDOR offers various tax relief programs for eligible taxpayers, including those affected by natural disasters or economic hardships. Details of these programs are available on the department’s website.

How does the SCDOR ensure the security of taxpayer information?

The SCDOR employs advanced security measures, including encryption and secure access protocols, to protect taxpayer information from unauthorized access and cyber threats.

Conclusion

The South Carolina Department of Revenue plays an indispensable role in the state’s economic framework, ensuring that tax laws are enforced and public funds are managed efficiently. Through its diverse functions and responsibilities, the department not only supports the state’s fiscal health but also contributes to a stable and prosperous economic environment. By continuously adapting to technological advancements and addressing emerging challenges, the SCDOR remains committed to serving the people of South Carolina with integrity and transparency.