Lendmark Financial has established itself as a trusted name in the financial services industry, offering personalized loan solutions to individuals and families who need assistance navigating their financial journeys. With a commitment to customer satisfaction and tailored services, Lendmark Financial stands apart as a reliable partner for borrowers seeking manageable and accessible credit options.

Founded with the mission of providing financial relief and empowerment, Lendmark Financial has grown steadily over the years, catering to a diverse clientele. Whether you're looking for personal loans, auto loans, or debt consolidation options, the institution prides itself on simplifying the lending process with transparent terms and competitive rates. Their dedication to creating meaningful financial solutions reflects their belief in fostering long-term customer relationships.

In this guide, we will dive deep into everything you need to know about Lendmark Financial, from the services they offer to the benefits of choosing them as your financial partner. We'll also address common inquiries and provide valuable insights into how Lendmark Financial can help you achieve your financial goals. So, let’s get started!

Read also:Why D Brand Stands Out The Ultimate Guide To Its Excellence

Table of Contents

- Who is Lendmark Financial?

- What Services Does Lendmark Financial Offer?

- How Does Lendmark Financial Stand Out?

- Who Can Benefit from Lendmark Financial's Services?

- How to Apply for a Loan with Lendmark Financial?

- What Are the Benefits of Choosing Lendmark Financial?

- Lendmark Financial vs. Other Lenders: A Comparison

- Common Questions About Lendmark Financial

- What Are the Requirements for Loans?

- How Does Lendmark Financial Handle Customer Service?

- Can I Refinance with Lendmark Financial?

- Tips for Managing Loans Effectively

- Lendmark Financial Success Stories

- FAQs About Lendmark Financial

- Conclusion

Who is Lendmark Financial?

Lendmark Financial is a leading consumer finance company specializing in personal loans, debt consolidation, and auto loans. Established with the mission to provide reliable and flexible lending solutions, the company focuses on helping individuals and families achieve their financial goals. With over 20 years of experience, Lendmark Financial has become a trusted partner for thousands of borrowers across the United States.

Company Overview

Lendmark Financial operates on the principles of transparency, customer satisfaction, and personalized service. They aim to make the borrowing experience as seamless as possible for their clients. By offering a variety of loan options and competitive rates, the company ensures every customer finds a solution tailored to their unique financial needs.

Key Personal Details in Table Format

| Aspect | Details |

|---|---|

| Founded | 1996 |

| Headquarters | Covington, Georgia, USA |

| Specialization | Personal Loans, Auto Loans, Debt Consolidation |

| Website | https://www.lendmarkfinancial.com |

What Services Does Lendmark Financial Offer?

Lendmark Financial provides a suite of financial services designed to cater to various customer needs. Whether you're managing unexpected expenses or planning for a significant purchase, their offerings are structured to support your financial well-being.

Personal Loans

Personal loans are one of the flagship products offered by Lendmark Financial. These loans are versatile and can be used for a variety of purposes, such as medical expenses, home improvements, vacations, or emergencies. With flexible repayment terms and competitive interest rates, these loans are tailored to fit your budget.

Auto Loans

Whether you're buying a new or used car, Lendmark Financial provides auto loans with straightforward terms. Their auto loans are designed to simplify the car-buying process, ensuring that you drive off the lot with confidence and financial clarity.

Debt Consolidation

If you're struggling with multiple debts and high-interest rates, Lendmark Financial's debt consolidation loans can help you streamline your payments and potentially save money. By combining your debts into a single loan with a manageable monthly payment, you can regain control of your finances.

Read also:Uss Nemo A Deep Dive Into Its History Features And Significance

How Does Lendmark Financial Stand Out?

Unlike many other financial institutions, Lendmark Financial prioritizes personalized service and customer relationships. They understand that every borrower has unique financial needs, and they strive to provide tailored solutions that work for each individual.

Key Differentiators

- Flexible loan terms to accommodate varying financial situations

- Competitive interest rates that are often lower than those offered by traditional banks

- Transparent lending practices with no hidden fees

- Commitment to customer education and financial literacy

Who Can Benefit from Lendmark Financial's Services?

Lendmark Financial serves a broad spectrum of customers, including those with less-than-perfect credit. Their services are particularly beneficial for individuals and families who need financial assistance but may not qualify for traditional bank loans.

Ideal Candidates

- Individuals with urgent financial needs

- Borrowers looking for flexible repayment options

- Consumers who want to consolidate their debts

- Car buyers seeking straightforward auto loans

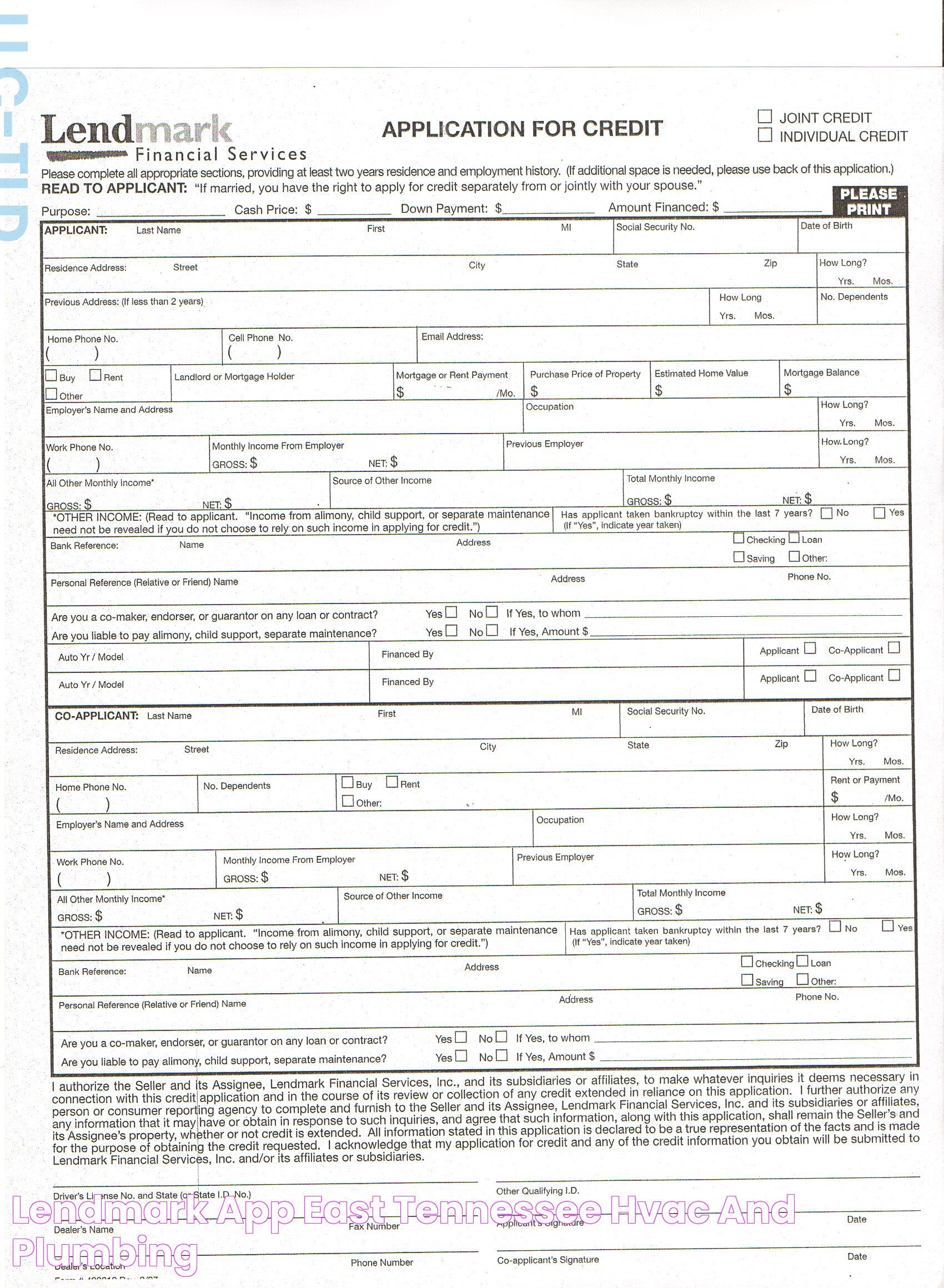

How to Apply for a Loan with Lendmark Financial?

Applying for a loan with Lendmark Financial is a straightforward process. The company has streamlined its application procedure to make it as convenient as possible for borrowers.

Application Process

- Visit the official Lendmark Financial website.

- Fill out the online application form with accurate details.

- Submit your application and wait for a response from the Lendmark Financial team.

- If approved, review the loan terms and conditions before signing the agreement.

- Receive your funds and start using them as intended.

What Are the Benefits of Choosing Lendmark Financial?

Choosing Lendmark Financial as your lending partner comes with numerous advantages, from flexible loan options to exceptional customer service.

Key Benefits

- Personalized loan solutions

- Quick and easy application process

- Competitive interest rates

- Access to financial experts for guidance

Lendmark Financial vs. Other Lenders: A Comparison

When compared to other lenders, Lendmark Financial stands out for its commitment to transparency and personalized service. While traditional banks may have stricter requirements and less flexible terms, Lendmark Financial focuses on meeting the unique needs of its customers.

Common Questions About Lendmark Financial

Here are some frequently asked questions that can provide further insights into Lendmark Financial's services and processes.

What Are the Requirements for Loans?

Lendmark Financial has straightforward eligibility criteria for its loans. Generally, you'll need to provide proof of income, a valid government-issued ID, and a clear understanding of your financial needs. Specific requirements may vary depending on the loan type.

How Does Lendmark Financial Handle Customer Service?

Lendmark Financial takes pride in offering exceptional customer service. Their team is readily available to address queries, resolve issues, and provide guidance throughout the lending process. Customers can reach them via phone, email, or in-person visits to their branches.

Can I Refinance with Lendmark Financial?

Yes, Lendmark Financial offers refinancing options for eligible loans. Refinancing can help you secure better interest rates, lower monthly payments, or adjust your loan terms to better suit your financial situation.

Tips for Managing Loans Effectively

Proper loan management is crucial for maintaining financial health. Here are some tips to help you manage your loans effectively:

- Create a budget and stick to it

- Set up automatic payments to avoid missing due dates

- Communicate with your lender if you encounter financial difficulties

- Consider refinancing if it offers better terms

Lendmark Financial Success Stories

Over the years, Lendmark Financial has helped countless individuals and families achieve their financial goals. From consolidating debts to funding life's milestones, their customers' success stories are a testament to the company's dedication and effectiveness.

FAQs About Lendmark Financial

1. What types of loans does Lendmark Financial offer?

Lendmark Financial offers personal loans, auto loans, and debt consolidation solutions tailored to individual needs.

2. How long does it take to get approved for a loan?

Loan approval times can vary, but many applicants receive a decision within 24-48 hours.

3. Can I apply for a loan online?

Yes, Lendmark Financial provides an online application process for added convenience.

4. What credit score do I need to qualify?

Lendmark Financial caters to a wide range of credit scores, including individuals with less-than-perfect credit.

5. Are there any hidden fees associated with their loans?

No, Lendmark Financial is committed to transparency and does not charge hidden fees.

6. Is Lendmark Financial available nationwide?

Lendmark Financial operates in multiple states across the U.S., but availability may vary by location.

Conclusion

Lendmark Financial is a dependable institution for anyone seeking flexible and accessible loan options. With a focus on customer satisfaction, competitive rates, and personalized services, they have built a reputation as a trusted financial partner. Whether you're looking to consolidate debt, purchase a vehicle, or manage unexpected expenses, Lendmark Financial offers solutions tailored to meet your unique needs. Reach out to them today and take control of your financial future!